Virgin Money Australia

Dane Carmody

Vaughan Moffitt

Stephen Yoon

Brandon Lam

Harry Mann

2019

Senior UX Consultant

The Virgin brand is trusted globally and well-known for shaking things up. Virgin Money Australia is part of the global Virgin brand and network. It is 100% owned by the Bank of Queensland (BOQ) Group. Virgin Money Australia's home loans, credit cards, insurances and superannuation are all backed by long-standing partnerships with leading organisations like BOQ, NAB, Mercer, TAL, Auto & General and Allianz Worldwide Partners.

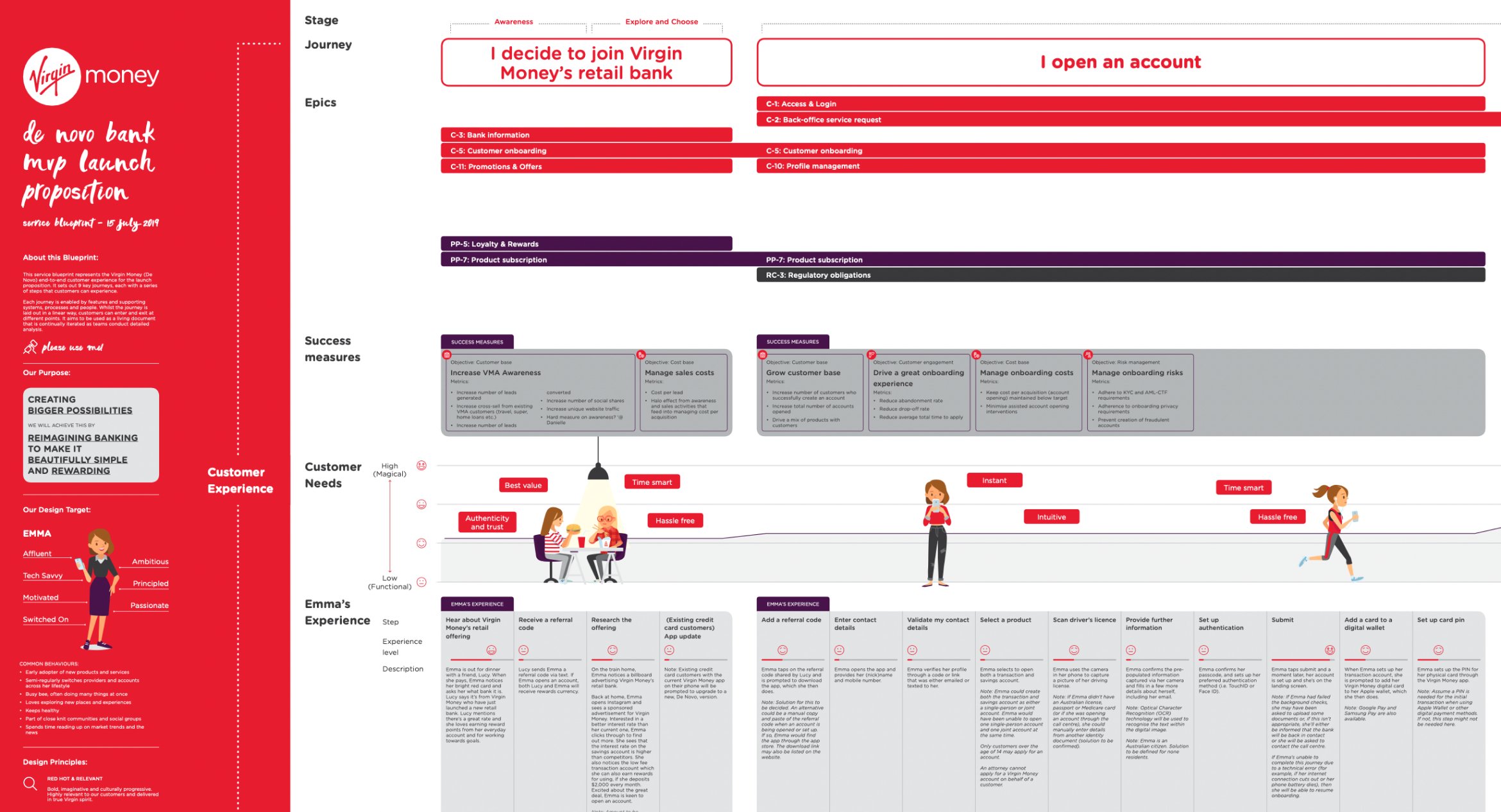

Building VMA’s digital-first challenger bank from scratch

Deloitte was approached by Virgin Money Australia to design a proposition that reimagined the future of banking, was differentiated in the market, and shared value between VMA and its customers. At the time, VMA's product offering was limited to credit cards issued by Citibank. Extensive research was conducted by Deloitte’s service designers and formulated into a proposition for VMA’s future digital bank. It was framed by four key pillars:

Open data – leveraging customer data through Open Banking

Ecosystem – creating a networked ecosystem that creates value for customers

Compelling proposition – a proposition that grows VMA’s customer base

Brand – create a truly Virgin experience

Feature elaboration

In the early stages of the engagement, I worked with the business analysts to facilitate workshops with the client. The goal of these workshops was to elaborate the five features of the core banking experience into detailed user stories, user flows and wireframes in preparation for build. After the user flows were approved by the client, I created lo-fi wireframes, which were later refined by visual designers. My squad and I were responsible for the following features of the mobile banking experience:

Product subscription – how a customer applies for a banking product within the VMA mobile app

Account management – management of individual accounts

Statements – accessing and creating bank statements

Payments – transfers and payments via BPay, PayID and bank transfer

Open Banking – sharing external banking data with VMA, for account aggregation and proactive insights

Goals Accelerator – creation of financial goals and proactive insights

I created user flows for each epic to visualise the user experience. These flows became the centrepiece of the workshops, allowing the client to discuss related business rules or considerations. This engagement consisted of 70+ consultants from different parts of Deloitte, and the user flows became a key communication tool, driving alignment between teams. Each user flow mapped out the customer and employee experience, back office processes or systems, integration points, pending decisions and business rules.

Designing for the customer’s mental model of savings buckets

One of the challenging epics in this project was the Goals Accelerator. This part of the app allowed customers to set savings goals. As the customer progressed towards the completion of their goals, they would be rewarded. By helping customers reach their savings goals, VMA would be able to cross-sell a variety of products to help them on this journey. For example, Emma sets up a travel goal to save $2000 for a trip to Bali. Once she completes the goal, VMA could offer Emma discounted tickets to Bali, through Virgin airlines.

I wanted to understand the underlying mental model between a transaction account, savings account and financial goals. In almost all of the banking apps I analysed, a customer was required to go through the regular product subscription flow which included agreeing to terms and conditions. After the account was set up, the customer would be prompted to create a savings goal. I found this model to be a limiting way of representing how people actually save. I hypothesised that a customer who has 1 savings account, was likely to be saving for multiple goals, not just 1.

For example, Emma has one transaction account for everyday spending and one savings account where she deposits a percentage of her monthly income. Emma is saving to put a deposit down on her first property, but at the same time, she is also saving for a short trip to Bali. She buckets all her savings into one savings account and has to mentally account for her two savings goals.

How do customers think about their goals in relation to their savings account?

Is a goal the same thing as an account? Or are goals subdivisions of a single account?

These were interesting questions that required us to better understand the psychology of our users. Our ability to explore these mental models was limited by the functionality of the core banking platform and the business cost of opening accounts. With these constraints, I needed to think creatively about how to recycle a savings account for different goals and design an experience that would encourage positive financial behaviour.

Prototyping the solutions to test

I created an interactive prototype, which we guerilla tested with 7 participants. In this prototype, customers were required to open an account, set a savings goal i.e. 1 savings account = 1 savings goal), and on completion of their goal, customers would be prompted set and save towards a new goal.

Through two rounds of testing, we found that customers generally think of their savings account as a bucket, with sub-divisions for their different goals. We were limited by the technical contraints of the core banking platform and were unable to implement a solution that truly matched the user's mental model of savings goals.

Reflection

This was undoubtedly a challenging engagement, given the sheer size of the team. At the time, financial goal creation was a new concept that was being introduced into many banking apps in a rudimentary form. This was a great opportunity to push the boundaries of habit creation, goal achievement and financial education. In a further iteration, I would have liked to research and implement a solution along the lines of today's N26 spaces feature.

The VMA mobile app went live at the end of 2020.